- TOKENS by Crypto Endevr

- Posts

- The Corporate Bitcoin Treasury Revolution: Bullish Now, Black Swan Later?

The Corporate Bitcoin Treasury Revolution: Bullish Now, Black Swan Later?

Why 140+ Companies Hoarding Bitcoin Could Be 2025’s Biggest Market Risk

This Week on CRYPTO ENDEVR:

While Bitcoin hit new all-time highs above $123,000 this week, a quiet revolution has been unfolding in corporate boardrooms across America. Over 140 public companies now hold Bitcoin in their treasuries, collectively controlling hundreds of thousands of coins, and they’re not slowing down.

The numbers are staggering:

- Corporate buyers outpaced ETF purchases for three consecutive quarters

- Public companies accumulated 131,000 BTC in Q2 alone (18% growth)

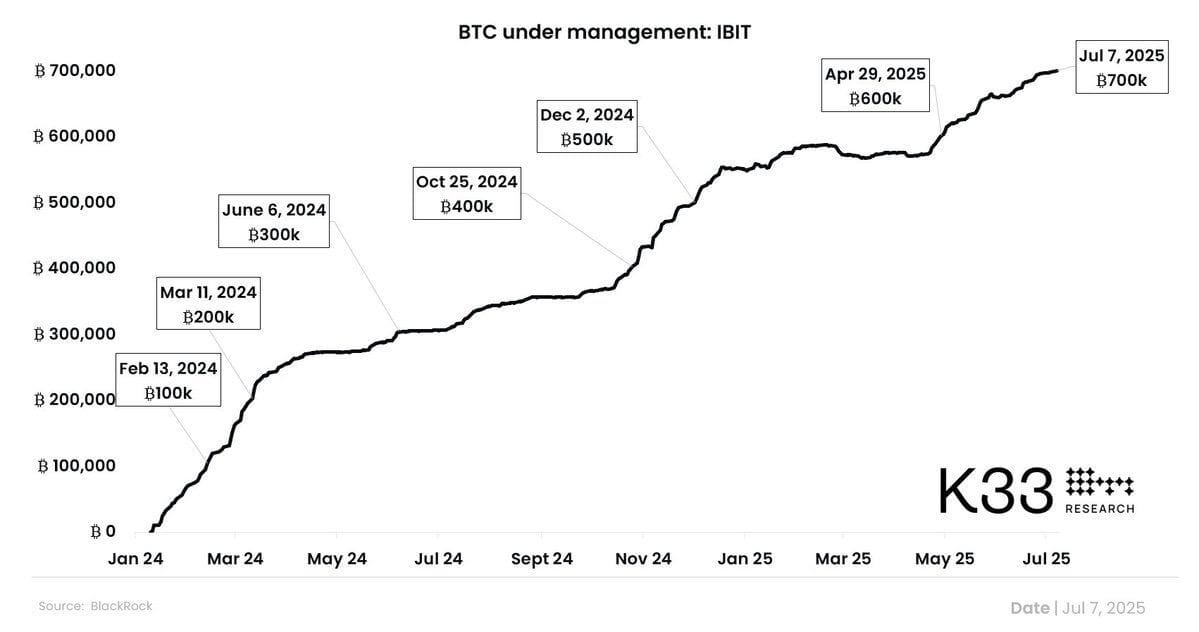

- BlackRock’s ETF holds 700,000+ BTC with $76 billion in assets

- Bitcoin supply on exchanges has fallen to 2018 lows

This represents a fundamental shift in how corporations view money itself. But as this treasury revolution accelerates, a darker question emerges: What happens when these companies need to sell?

The MicroStrategy Effect Goes Mainstream

It started with one visionary, or madman, depending on who you ask. Michael Saylor’s Strategy (formerly MicroStrategy) pioneered the corporate Bitcoin treasury playbook in 2020, accumulating over 600,000 BTC and creating a template others are now frantically copying.

The playbook is deceptively simple:

1. Raise capital through equity or debt

1. Convert cash to Bitcoin

1. Leverage the “sound money” narrative to justify premium valuations

1. Use elevated stock prices to raise more capital

1. Repeat

Recent corporate adopters include:

- GameStop: Added Bitcoin as treasury reserve asset

- Trump Media: Plans to raise $3B for Bitcoin purchases

- Metaplanet Japan: Becoming Asia’s MicroStrategy

- 26 companies started holding Bitcoin in June 2025 alone

Mark Palmer, senior equity research analyst at The Benchmark Company noted: “Companies that have seen their stock struggle… often because their business models are not particularly compelling in the eyes of many investors, they have opted to follow MicroStrategy’s lead.”

$MSTR just closed at an all-time high market cap.

— Michael Saylor (@saylor)

8:47 PM • Jul 16, 2025

The Perfect Storm

Why This Rally Feels Different

Three forces are converging to create an unprecedented supply squeeze:

1. ETF Institutional Demand

BlackRock’s IBIT alone pulled in $6.35 billion in May, its largest monthly inflow since launch. The fund now generates more revenue than BlackRock’s flagship S&P 500 ETF despite being nine times smaller.

2. Corporate Direct Buying

Public companies acquired 131,000 BTC in Q2 versus 111,000 for ETFs. For the first time, corporations are outbuying the institutional vehicles designed for Bitcoin exposure.

3. Supply Scarcity

Only 12% of Bitcoin’s circulating supply remains on exchanges, the lowest since 2018. Every corporate purchase removes coins from tradeable supply, potentially forever.

The self-reinforcing cycle:

- Corporate adoption → Media attention → Higher prices

- Higher prices → More corporate FOMO → More adoption

- More adoption → Supply scarcity → Even higher prices

Bull Case

This Rally is Different

Institutional Validation: When public companies commit eight and nine-figure sums to Bitcoin, it signals something traditional gold bugs never achieved; corporate America’s explicit endorsement of digital assets.

Regulatory Clarity: Congress is holding “Crypto Week” this week, with potential passage of legislation that could further legitimize corporate Bitcoin holdings.

Network Effects: Every new corporate adopter makes it easier for the next company to justify similar moves. The playbook is proven, the accounting is understood, and the regulatory path is clearer.

Long-term Holders: Unlike retail investors who panic-sell, corporate treasuries are structured for long-term holding. They’re removing Bitcoin from circulation for years or decades, not months.

Nick Marie, head of research at Ecoinometrics noted: “The institutional buyer who is getting exposure to bitcoin through the ETFs are not buying for the same reason as those public companies who are basically trying to accumulate bitcoin to increase shareholder value.”

👉 Enjoying this issue? Don’t keep it to yourself—share the knowledge! 📤 Forward this newsletter to your friends and share your favorite takeaways on social media with #TokensNewsletter!

The Black Swan

When Corporations Become Forced Sellers

But here’s the uncomfortable truth nobody wants to discuss: corporate Bitcoin holdings create systematic risk that didn’t exist before.

The “NAV Death Spiral” Scenario:

A recent analysis outlines how this could unfold:

1. Bitcoin price crashes (geopolitical crisis, regulatory crackdown, etc.)

1. Corporate NAV premiums collapse as stock prices fall below Bitcoin holdings value

1. Access to capital tightens as investors lose confidence

1. Forced liquidations begin as companies face margin calls or debt maturations

1. Selling pressure accelerates the Bitcoin decline, triggering more corporate distress

The concentration risk is real:

- Strategy alone holds 600,000+ BTC (2% of total supply)

- Top 10 corporate holders control massive positions

- Many used leverage or debt to fund purchases

- Corporate treasuries aren’t designed for -50% drawdowns

Questions Nobody’s Asking

What’s the exit strategy? Corporate treasuries are built for stability, not volatility. How do CFOs explain to shareholders why the company’s “treasury asset” is down 60%?

Who sells first? In a liquidity crisis, will corporations maintain their “diamond hands” mentality, or will fiduciary duty force them to cut losses?

What about leverage? Some companies borrowed to buy Bitcoin. What happens when lenders demand repayment during a market crash?

Regulatory risk: What if new accounting rules require mark-to-market losses on Bitcoin holdings? Or if tax policy changes make corporate Bitcoin holdings prohibitively expensive?

Shareholder lawsuit risk: If Bitcoin crashes and corporate performance suffers, will shareholders sue management for prioritizing crypto speculation over core business?

Liquidity Time Bomb

A scenario that keeps smart money awake at night:

Say Bitcoin drops 40% over weeks due to a major regulatory crackdown. Corporate treasuries that seemed genius at $120K now face intense pressure:

- Quarterly earnings calls become explaining sessions about crypto losses

- Credit rating agencies downgrade companies with significant Bitcoin exposure

- Activist investors demand management changes and Bitcoin sales

- Margin calls force leveraged companies to liquidate positions

- Copycat selling accelerates as other corporations try to exit before peers

Liquidity problem: Bitcoin’s 24/7 nature means corporate selling pressure doesn’t pause for weekends or holidays. Unlike traditional assets, there’s no circuit breaker, no trading halt, no cooling-off period.

Cascade effect: Each corporate sale creates negative headlines, triggering more sales. The same network effects that drove adoption could accelerate the exodus.

The Bottom Line

A Corporate Bitcoin treasury revolution is real, accelerating, and fundamentally bullish for Bitcoin in the short term. Supply dynamics, institutional validation, and self-reinforcing adoption cycle create a powerful upward force that could drive prices significantly higher.

However, this same revolution creates systematic risk that didn’t exist before. When corporations become forced sellers; whether due to leverage, shareholder pressure, or liquidity needs, the selling pressure could be unlike anything Bitcoin has experienced.

Questions investors should be asking:

- How many of these corporate holders are truly “diamond hands” versus fair-weather friends?

- What percentage of corporate Bitcoin holdings are leveraged or debt-funded?

- At what price point does fiduciary duty override “HODL” mentality?

- How quickly could sentiment shift from “treasury asset” to “speculative liability”?

The corporate Bitcoin treasury revolution isn’t just changing how companies think about money, it’s changing Bitcoin’s risk profile forever. The same institutional adoption that’s driving today’s rally could become tomorrow’s systematic risk.

Smart money is watching the corporate treasury space closely. Not just for the next buying wave, but for the first signs of forced selling that could trigger the next major correction.

Stay Vigilant. The revolution is bullish, until it isn’t..

UNBOUND: Founders Edition

This Week: Full Sail's Revolutionary DeFi Innovation

Our latest Founders Spaces session featured an incredible deep-dive with Bonnie and Gulpta from Full Sail - the team building what they call "the most capital efficient DEX in the galaxy."

What Made This Special:

🔹 Real Stories Behind the Tech

Bonnie's journey from door-to-door sales to DeFi adoption specialist

Gulpta's background in particle physics research contributing to Higgs boson discovery

How they balance being a couple while co-founding a groundbreaking protocol

🔹 Innovation That Matters

200% more capital efficient than existing VE3,3 models

Novel prediction markets integrated into governance

Disinflationary tokenomics that actually work

Patents pending on their financial mechanics

🔹 Community-First Approach

Over 2,000 participants in their first prediction competition epoch

Community seed round access (not just VCs)

Building for long-term sustainability, not quick extraction

Founders Spaces Goal

"What I've learned through the whole thing is, you know, when you have a really great relationship with somebody and you can find ways to work through hardships... those relationships matter more than even the dollar." - Mike Founder of Crypto Endevr

These aren't just project showcases - they're deep conversations about the people behind the innovation. We explore:

✅ Origin Stories - Where founders came from and what drives them

✅ Real Challenges - How teams navigate building together and relationships

✅ Vision & Values - What success really means beyond just price action

✅ Technical Deep-Dives - Understanding the actual innovation, not just the hype

To catch the full spaces, click the photo below!

Crypto Endevr is always on the lookout for the latest news and trends in the world of blockchain technology, but it’s not possible without you. Thank you for your support. We look forward to navigating the crypto landscape together in 2025 and beyond!

News From This Week You Might Have Missed:

This analysis is based on publicly available data and market research. Past performance does not guarantee future results. Always conduct your own research before making investment decisions.