- TOKENS by Crypto Endevr

- Posts

- Perpetual Futures: The New Hot Commodity in Crypto?

Perpetual Futures: The New Hot Commodity in Crypto?

While Bitcoin surges to new heights, many traders are left wondering where to deploy their risk appetite as meme coins cool and NFTs struggle. The answer might be sitting right in front of them: perpetual futures trading.

When Traditional Degen Plays Go Cold

The numbers tell a compelling story about shifting market dynamics. NFT trading volume plunged 50% quarter-over-quarter to $1.1 billion in Q3 2024, while meme coin market caps have seen significant declines with Dogecoin down 21.7% and Shiba Inu falling 10.6% over recent periods. Even Google Trends data shows searches for "meme coin" nosediving from a peak score of 100 in mid-January to a mere 8 last week.

As traditional "degen" plays lose steam, smart money is flowing toward more sophisticated instruments. Bitcoin perpetual futures boasted an average daily volume of $57.7 billion on weekdays in Q1 2024, dwarfing the $18.8 billion in spot trading. This staggering 3:1 ratio highlights where the real action is happening.

Why Perpetual Futures Support Chain Ecosystems:

Volume amplification: The top 10 centralized perpetual exchanges recorded $58.5 trillion in trading volume in 2024, making it the most active perpetual trading year ever

Fee generation: Perpetual trading generates substantial revenue for protocols through funding rates and trading fees

Liquidity attraction: High-volume trading draws market makers and institutional participants to blockchain ecosystems

User retention: Sophisticated trading tools keep advanced traders engaged with specific chains longer than simple spot trading

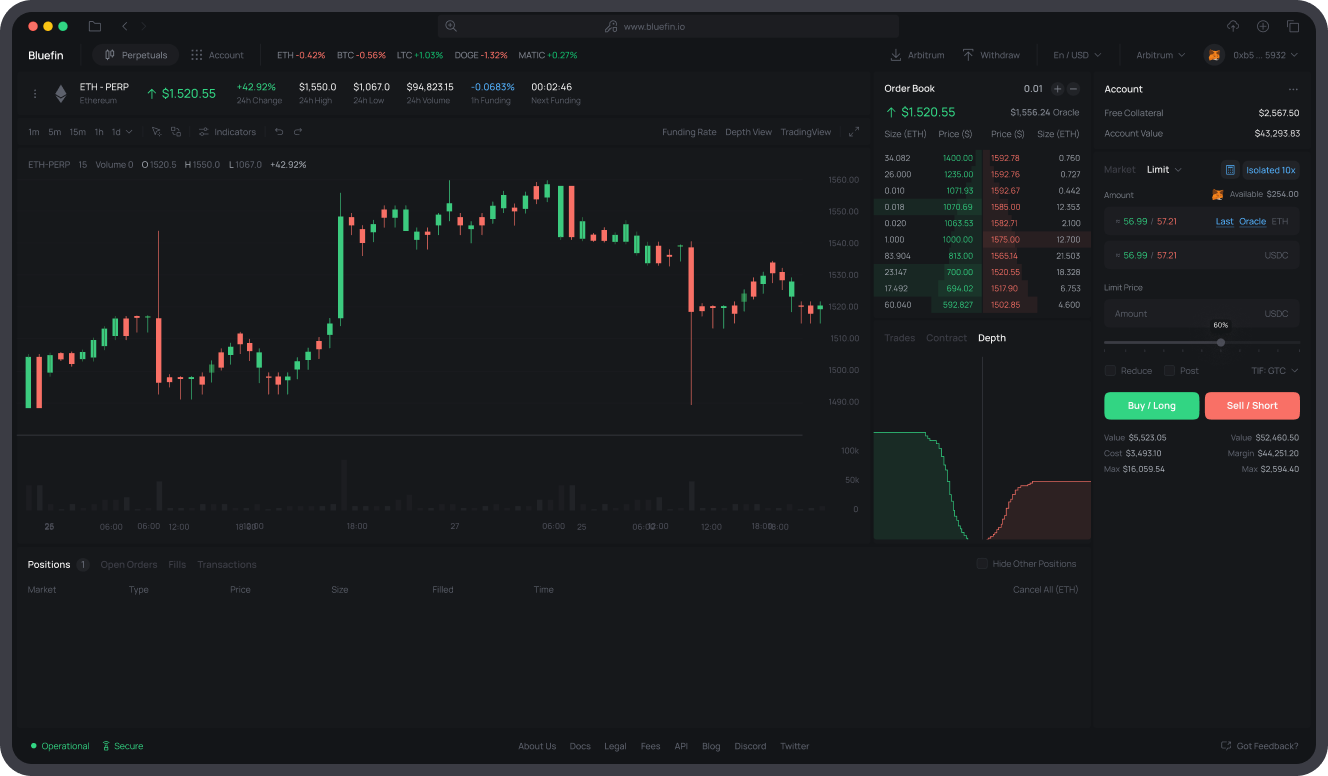

Bluefin: Leading the Perpetual Revolution on Sui

Bluefin is a sponsor of Tokens Newsletter

When it comes to perpetual trading on emerging chains, Bluefin stands as the undisputed leader in the Sui ecosystem. With over $43 billion in trading volume since launching in September 2023, Bluefin has become the largest protocol on Sui by total volume.

What sets Bluefin apart isn't just volume, it's performance. Built on Sui's unique architecture, Bluefin achieves optimistic trade confirmations in just 30 milliseconds with final settlement in 550 milliseconds, while maintaining transaction fees consistently below $0.005. These metrics match traditional finance standards, something no other decentralized perpetual exchange has achieved.

Why Bluefin Is Different:

Real rewards for real trading: Unlike other DEXs, Bluefin pays traders actual rewards through $SUI + Blue Points based on fees paid. The more you trade, the more you earn

Exceptional LP opportunities: Current popular APRs include SUI-USDC at 551% and DEEP-SUI at 400%

Hybrid orderbook model: Combines off-chain speed with on-chain settlement for optimal performance

zkLogin integration: Users can trade using Google or Apple credentials, eliminating wallet friction

Loyalty recognition: The Leagues program tracks consistent traders, signaling the platform's commitment to rewarding active users

What sets Bluefin apart isn't just performance, it's philosophy. While other exchanges extract value, Bluefin redistributes it back to traders. With institutional backing from Polychain Capital, Brevan Howard, and SIG, plus $43 billion in trading volume, they've proven that rewarding users creates sustainable growth.

As our CEO noted in his ambassador announcement: "Bluefin is doing what every other DEX should be doing. Paying users REAL rewards for trading and being active. In fact, they're doing it better than anyone right now."

I’ve been involved with Defi for years.

I recently joined @bluefinapp as an ambassador.

Because what they’re building is legit, and most traders have no idea the rewards their missing by not using Bluefin!🔥It's not a new token. It's not a new platorm.

It’s a DEX that— MikeNielsen (@HavenMediaCo)

5:54 PM • Apr 25, 2025

For traders seeking institutional-grade perpetual trading that actually pays them back, Bluefin represents the current gold standard. Learn more:

Key Insights from Our Sui Ecosystem Conversation

Each week, we sit down with founders building the future of Web3 on Sui. Our recent conversation with Zabi from Bluefin revealed fascinating insights into building in crypto and the evolution of perpetual trading. Despite a challenging day with the SEALX exploit affecting the broader Sui ecosystem, Zabi and his team demonstrated the resilience that defines successful builders.

Four standout takeaways from our discussion:

1. Building Through Adversity Creates Strength: Zabi shared how surviving the 2022-2023 bear market wasn't just about having resources, it was about maintaining core principles and being "risk averse" while building in a risk-on industry. "Every single week since we've first started, there's like 10 different wrenches that are being thrown at you," he noted, emphasizing that expecting the unexpected is crucial for long-term success.

2. Team Quality Over Quantity: Perhaps most striking was Bluefin's lean structure. 85% of their team is engineering, with only six people handling everything from design to marketing to community. This focus on finding "people who love what they do" and are "genuine and kind humans" has enabled them to process $50+ billion in trading volume with minimal overhead.

3. Capital Efficiency as the New Frontier: Zabi outlined Bluefin's evolution from a single perpetual product to an integrated ecosystem including spot trading, lending (through Alpha Land collaboration), and their upcoming Pro platform. The goal isn't just offering more products, it's creating "capital efficiency" where users can benefit from every product in the ecosystem simultaneously.

4. Performance Standards That Match Traditional Finance: With Bluefin Pro launching soon, the focus is achieving settlement speeds that "shouldn't feel any different" from trading on Binance or Bybit. Cross-margin trading, ultra-high liquidity, and sub-second latencies represent the next evolution of DeFi infrastructure.

The conversation reinforced why Sui's performance capabilities attracted Bluefin in 2022. A decision that seemed contrarian then but proved prescient as the ecosystem flourished.

What creates staying power in crypto? @zabimx from @bluefinapp breaks it down:

In a space full of talent, long-term winners put ego aside and stick to their principles.

Incredible insights from our #UnboundFounders space, check out the full recording below 🎙️👇

— CRYPTO ENDEVR (@CryptoEndevr)

10:54 PM • Jun 30, 2025

The Bottom Line: Where Smart Money is Moving

As meme coin fever cools and NFT volumes stabilize, perpetual futures are emerging as the sophisticated trader's playground of choice. With Bitcoin perpetual futures showing three times the daily volume of spot trading and platforms like Bluefin proving that decentralized derivatives can match centralized performance, the writing is on the wall.

The shift represents a maturation of crypto markets. While retail traders chase the next 100x meme coin, institutions and sophisticated traders are building positions through perpetual futures, generating real volume, sustainable fees, and lasting ecosystem value.

For blockchain ecosystems, attracting perpetual trading volume isn't just about revenue, it's about proving institutional viability. Chains that can support high-performance derivatives trading will capture the next wave of crypto adoption.

The perpetual futures revolution is here. The question isn't whether it will reshape crypto trading, it's which protocols will capture the largest share of this massive market opportunity. Our bets on Bluefin!

1/ Bluefin’s North Star: Become the most powerful on-chain trading venue.

Since its launch, Bluefin has processed over $50B, making it the number one protocol on @SuiNetwork by total trading volume. Now, we go 10x bigger, with Bluefin Pro, BluefinX, and Bluefin Spot v2 — all

— Bluefin (@bluefinapp)

3:48 PM • Jan 31, 2025

👉 Enjoying this issue? Don’t keep it to yourself—share the knowledge! 📤 Forward this newsletter to your friends and share your favorite takeaways on social media with #TokensNewsletter!

UNBOUND: Founders Edition

SOUL SEED: Building the Future of Web3 Gaming

In our recent Founder's Edition space, we sat down with Davey from Soul Seed, whose journey from coding at age 7 to building what he calls "the Roblox of Web3 gaming" exemplifies the builder mindset driving Sui's ecosystem forward.

Humble Beginnings to Platform Builder: Davey's path began in the 1980s with a Radio Shack computer and a BASIC manual, learning to code D&D character creators as a kid. His journey through Microsoft tech support, Army service, game development at Turbine Games (Lord of the Rings Online), and eventually discovering Web3 through Rally Network shaped his vision for democratizing game creation.

The Soul Seed Vision: What sets Soul Seed apart isn't just another game, it's a comprehensive gaming platform where anyone can build, modify, and monetize games without deep coding knowledge. Using AI tools and simplified interfaces, creators can launch games in hours rather than months, with built-in NFT integration, marketplace functionality, and cross-game asset compatibility.

Community-Driven Growth: The platform's genius lies in its community-first approach. Each NFT collection gets its own branded gaming area, traits affect gameplay across all games, and revenue flows back to players, creators, and asset owners. As Davey noted: "We want to push revenue back into the hands of the players and communities who make games successful."

Why Sui Changed Everything: For Davey, Sui's object-centric programming model eliminated years of complex infrastructure work. "What took me years to build on other chains, I accomplished in a weekend on Sui," he explained, highlighting how the platform enables rapid iteration and deployment that Web3 gaming desperately needs.

Crypto Endevr is always on the lookout for the latest news and trends in the world of blockchain technology, but it’s not possible without you. Thank you for your support. We look forward to navigating the crypto landscape together in 2025 and beyond!