- TOKENS by Crypto Endevr

- Posts

- Bitcoin Hit $125K During a Shutdown. Here's Why Altseason Is Next

Bitcoin Hit $125K During a Shutdown. Here's Why Altseason Is Next

This Week on CRYPTO ENDEVR:

Bitcoin shattered expectations this weekend, surging to an all-time high of $125,689 on October 5, 2025, achieved not during economic prosperity, but amid a complete U.S. government shutdown.

The timing wasn't coincidental. As Washington descended into fiscal paralysis, institutional investors poured a record $1.21 billion into spot Bitcoin ETFs in a single day, pushing cumulative inflows past the $60 billion mark since launch.

Were experiencing the debasement trade in action. When traditional government systems falter, Bitcoin thrives as a hedge against political instability and currency weakening. Major financial institutions like Standard Chartered are now openly reaffirming $200,000 year-end targets, while BlackRock's IBIT fund has accumulated nearly 773,000 BTC, representing almost 4% of Bitcoin's entire supply.

Key Performance Metrics:

Bitcoin ATH: $125,689 (October 5, 2025)

Spot ETF single-day inflow record: $1.21 billion (October 6)

Cumulative ETF inflows: $60+ billion since launch

BlackRock IBIT holdings: 773,000 BTC (~$93 billion)

Current BTC dominance: 57-58% (down from 60%)

But here's what most investors are missing: Bitcoin's record-breaking rally isn't the main event. It's the opening act.

Three critical technical indicators are aligning to signal that we're entering the setup phase for the most significant altcoin season since 2021. October's catalyst stack could be the trigger that sends quality Layer-1 blockchains and established DeFi protocols into hyperdrive.

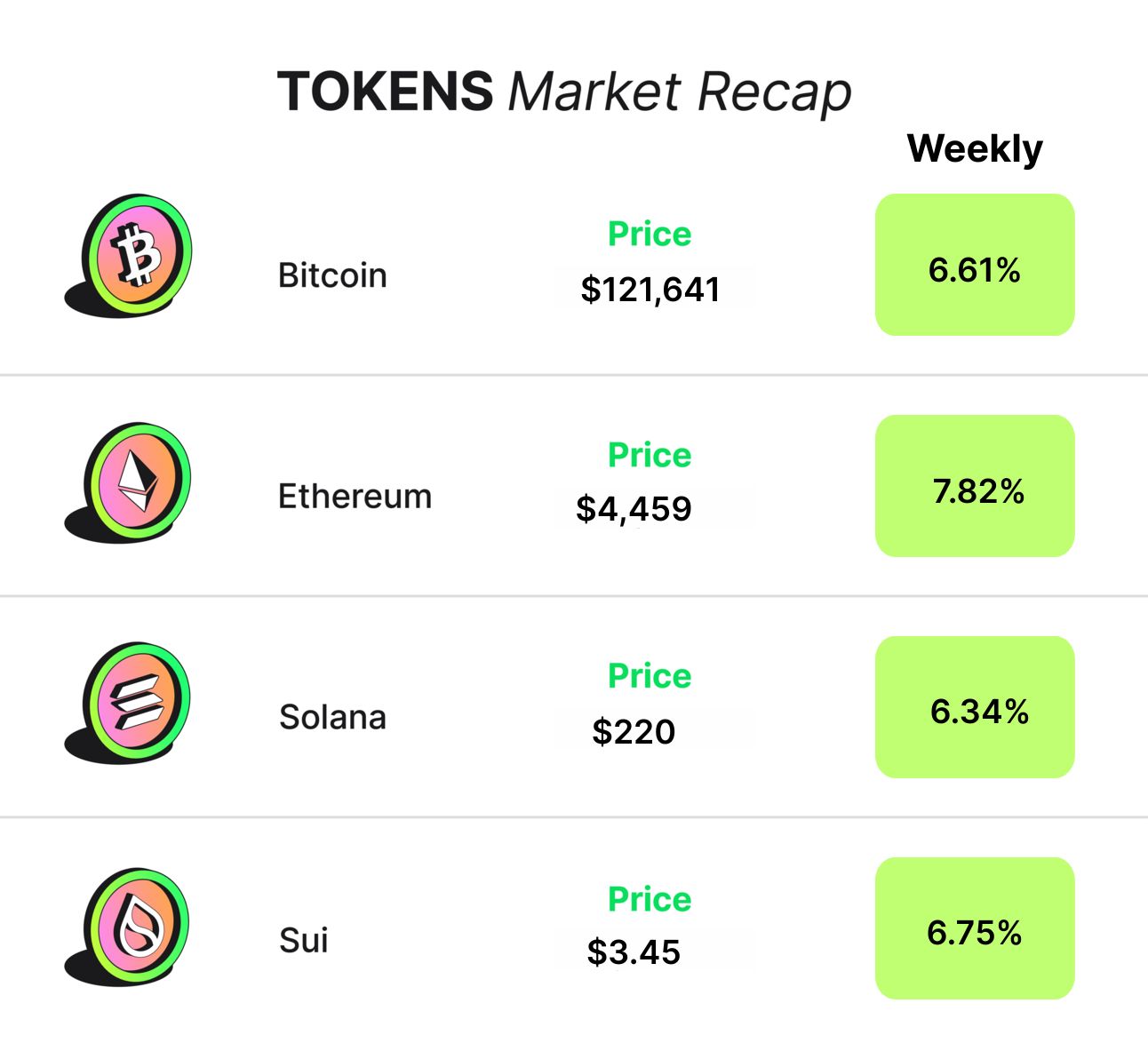

Taken 8:40pm EST 10/7

Bitcoin Dominance Is Cracking: The Technical Signal Everyone's Watching

For those unfamiliar with the metric, Bitcoin dominance measures BTC's market capitalization relative to the entire cryptocurrency market. When dominance is high, it means Bitcoin is outperforming altcoins. When it falls, capital is rotating from BTC into alternative cryptocurrencies.

Right now, Bitcoin dominance has dropped below 59% for the first time since the summer rally, currently sitting at 57-58%. Representing a pattern we've seen twice before at the exact same inflection points that preceded massive altcoin rallies.

The Historical Blueprint:

In both 2017 and 2021, Bitcoin dominance followed an identical trajectory. BTC would surge to new all-time highs, pushing dominance from around 65% to a local peak. Then, as institutional money took profits on their Bitcoin positions, dominance would crack below 59%, signaling the beginning of capital rotation into quality altcoins.

In 2017, this rotation sent Ethereum from $300 to $1,400 in a matter of months. In 2021, it catalyzed a sector-wide explosion that saw SOL rise 100x and AVAX climb 50x.

The mechanics are straightforward. Institutional investors enter the crypto market through Bitcoin first; it's the most liquid, most recognizable, and most regulatory-clear entry point.

As BTC approaches stretched valuations near all-time highs, these same institutions begin taking profits and searching for higher-beta opportunities with stronger fundamental growth trajectories. That's where established Layer-1 platforms, proven DeFi protocols, and gaming-focused blockchains come into play.

Current Market Positioning:

Bitcoin currently trades near $124,000 after its weekend surge, while Ethereum has broken decisively above $4,600 and is positioning for a potential breakout toward the $4,750-$5,000 zone.

The ETH/BTC ratio: Responsible for measuring Ethereum's performance relative to Bitcoin shows early signs of bottoming after months of underperformance. Another technical indicator that altcoin strength may be building beneath the surface.

Meanwhile, spot Bitcoin ETF data tells the story of institutional positioning. The $60 billion in cumulative inflows represents sustained, methodical accumulation rather than retail speculation.

BlackRock's IBIT fund alone now holds more Bitcoin than many sovereign nations, and its open interest in Bitcoin options has surpassed Deribit's, the traditional crypto-native exchange; marking a fundamental shift toward Wall Street-based derivatives activity.

This institutional infrastructure doesn't disappear when Bitcoin dominance falls. It rotates. And based on historical patterns and current technical setups, that rotation appears imminent.

Why is $BTC running again? 👇

Bitcoin just broke a new ATH above $125K and analysts are calling it the start of a new accumulation phase that could stretch toward $150K before 2025 ends.

💡Key drivers behind the move:

> US government shutdown → reignited BTC’s store-of-value

— 0xlav (@0xlav7)

1:35 PM • Oct 7, 2025

The Contrarian View: What Bears Are Saying

Not everyone shares the bullish outlook. Technical analysts have flagged several concerning signals that deserve acknowledgment.

Bitcoin's 20-day exponential moving average has crossed below both the 50-day and 100-day EMAs on certain timeframes. A bearish configuration known as a "death cross." The MACD indicator shows bearish momentum divergence.

In late September, market sentiment indices crashed from extreme greed (86%) to fear (sub-20%) in just two weeks.

Additionally, leveraged positions across altcoin futures markets saw brutal liquidations totaling over $600 million on October 7 alone, suggesting overleveraged traders were caught offsides by volatility.

Some 60,000 BTC were reportedly sent to exchanges at a loss in late September. Typically a capitulation signal that precedes further downside.

Recent options expiries also showed bearish positioning, with a 1.1 put/call ratio on the $4.3 billion in BTC and ETH options that expired October 4, indicating more traders betting on downside than upside in the near term.

2 out of 3 people think 2026 will be a bear market where bitcoin crashes. But what if bitcoin continues its yearly doubling, from $20k to $40k in 2023, to ~$80k in 2024, possibly $160k end of 2025, $320k 2026, $640k 2027. Wouldn't surprise me..

— PlanB (@100trillionUSD)

5:56 PM • Sep 7, 2025

Why the Bears Are Missing the Forest for the Trees:

While these technical concerns are valid in isolation, they ignore three critical countervailing factors that dwarf their significance.

First, sentiment extremes are mean-reverting. Historically, when sentiment indices drop below 20%, they don't signal the start of crashes; they signal bottoms.

The flush from 86% to sub-20% wasn't structural weakness; it was healthy market hygiene that cleared out overleveraged positions and reset sentiment for the next leg higher. Markets don't top on fear. They top on euphoria.

Second, October has historically been Bitcoin's strongest month. Since 2019, October has closed green every single year, with average returns of 21.89%.

More importantly, according to data from analyst Timothy Peterson, 60% of Bitcoin's annual performance occurs after October 3. Meaning we're entering the seasonally strongest period of the year, not exiting it.

Third, institutional positioning contradicts retail fear. While retail sentiment crashed, BlackRock's Bitcoin ETF just recorded its second-largest inflow day of the year at nearly $970 million on October 6.

Institutional allocators aren't panicking; they're accumulating. The fact that BlackRock's IBIT now exceeds Deribit in Bitcoin options open interest represents a seismic shift in market structure. Wall Street is positioning for upside, not downside.

The recent liquidations and exchange inflows at a loss? That's precisely the kind of capitulation event that clears weak hands before the next rally phase. Strong hands institutions with longer time horizons are absorbing that supply.

If Bitcoin were to break below $121,000, a retest of the $118,000-$120,000 support zone would be possible. But the preponderance of evidence, seasonal strength, institutional flows, and historical dominance patterns suggests that any pullback would be met with aggressive buying rather than cascading selling.

In December 2023, an anonymous user predicted Bitcoin would hit an all-time high cycle peak on October 6, 2025.

Yesterday, Bitcoin hit an all-time high on October 6, 2025. 🤯

If the pattern holds, the bear market low will happen on October 6th, 2026.

— Bitcoin Archive (@BTC_Archive)

12:28 PM • Oct 7, 2025

Smart Money Positioning: Quality Infrastructure Plays

Here's the critical insight most retail investors miss: Not all altcoins are created equal. The coming rotation won't lift every speculative token equally.

Instead, institutional capital will flow disproportionately toward Layer-1 blockchains with proven infrastructure, established DeFi protocols with real revenue, and gaming platforms with actual user bases.

The Current Altcoin Market Setup:

The altcoin market has been in an accumulation phase longer than any previous cycle. Longer than 2017. Longer than 2021.

This extended base-building has allowed quality projects to mature their technology, onboard users, and establish sustainable business models. Exactly the kind of fundamental development that supports higher valuations when capital begins rotating.

Total altcoin market capitalization (excluding Bitcoin) currently sits around $1.18 trillion, having already surpassed 2021 highs. Various altcoin momentum indices are showing accelerating strength, with some climbing from neutral readings in the 40s to approaching the 75+ threshold that historically signals confirmed altcoin season.

Google search volume for "altcoins" surged 40-50% in late September an early retail interest signal that typically precedes, rather than follows, major price moves.

October's Catalyst Stack:

What makes October 2025 particularly compelling is the convergence of multiple regulatory and product catalysts that could inject billions in fresh capital into quality altcoin projects.

The SEC faces decisions on approximately 16 altcoin ETF applications throughout October, including:

Multiple filings for Solana spot ETFs (deadlines October 2-10)

XRP spot ETFs (clustered around October 18-25)

Litecoin and Dogecoin applications

Market analysts are assigning 95% probability to XRP approval given the regulatory clarity achieved through Ripple's legal victory.

If even half of these applications receive approval, the precedent would be transformative. Solana exchange-traded products have already attracted $2.58 billion in year-to-date inflows globally, with a single week in early October setting a record of $706.5 million.

A U.S. spot ETF would dwarf those numbers by providing regulated access to the massive pool of institutional capital currently restricted to Bitcoin and Ethereum products.

Additionally, the CME is launching options on both Solana and XRP futures on October 13, 2025. This institutional derivatives infrastructure provides the hedging and leverage tools that sophisticated traders require before deploying significant capital.

Big week for Solana.

The final deadline for spot $SOL ETF approval is just 4 days away.

High chances we get the approval this week.

— Lark Davis (@TheCryptoLark)

10:34 AM • Oct 6, 2025

Sui: A Case Study in Infrastructure Maturation:

Among Layer-1 platforms, Sui represents an interesting example of the infrastructure maturation theme playing out in real-time.

In August 2025, the Sui blockchain processed $229 billion in stablecoin transfers. Demonstrating genuine economic activity rather than speculative token trading. This represented growth of over 700% compared to the previous quarter.

On October 1, Sui announced partnerships to integrate native stablecoin infrastructure in Q4 2025, becoming the first major non-EVM chain to offer this capability. The market responded with a 5% surge in SUI token price.

On October 20, Coinbase Derivatives will list SUI futures; providing institutional traders with regulated access to the ecosystem.

The pattern is clear: Layer-1 platforms that have used the accumulation phase to build real infrastructure, onboard real users, and establish institutional partnerships are positioning themselves to capture disproportionate capital inflows when the rotation accelerates.

Massive upgrades are coming to @SuiNetwork!!!

This will set a new benchmark for every other L1 in the game.

— Adeniyi.sui (@EmanAbio)

1:54 PM • Oct 7, 2025

Conclusion: Position, Don't Predict

The crypto market doesn't move in straight lines, and no analysis no matter how data-driven can eliminate uncertainty.

Bitcoin could absolutely retest $121,000 support, and a break below that level might trigger a move toward $118,000-$120,000 before the next leg higher. Short-term volatility is the price of admission to asymmetric long-term returns.

But step back and examine the converging evidence:

Bitcoin's surge to $125,689 during a government shutdown validated the debasement trade thesis that has underpinned institutional accumulation for the past year. Spot ETF inflows have now exceeded $60 billion cumulatively, with single-day records being broken as recently as this week. BlackRock alone holds nearly 4% of Bitcoin's total supply.

Meanwhile, Bitcoin dominance has cracked below 59% following the exact same pattern that preceded major altcoin rallies in both 2017 and 2021. The altcoin market has completed the longest accumulation phase in history, allowing quality infrastructure projects to mature.

And October brings a catalyst stack. ETF approvals, CME derivatives launches, institutional product expansions that could inject billions in fresh capital into the ecosystem.

Indicators to Watch:

Bitcoin dominance sustaining below 59% – Confirms capital rotation is underway

Altcoin momentum indices crossing above 75 – Signals confirmed altseason

ETH breaking decisively above $4,750 – Validates broad altcoin strength

The debasement trade brought Bitcoin to $125,000. History suggests the infrastructure rotation brings quality altcoins to new highs.

This pattern has repeated twice before. Once in 2017 and again in 2021 during similar technical setups. The current configuration suggests it may be happening again.

Position accordingly. Manage risk intelligently. And remember: October has historically been crypto's strongest month, with 60% of Bitcoin's annual performance occurring after October 3.

We're not at the end of this cycle. We're entering the phase where real wealth gets created in quality infrastructure plays.

The market is giving you a roadmap. It's up to you how you choose to follow it.

UNBOUND: Founders Edition

This week we had the pleasure of talking with 00Smurf! We dove deep into his 11-year crypto journey, from discovering Bitcoin in 2013 to becoming one of Sui's most influential community builders. Smurf shared exclusive insights on transitioning from Solana's "vile cesspool" to fostering collaborative growth on Sui, his philosophy of "wanting people to win," and how authentic relationship-building drives ecosystem success. His perspective on the evolution from early crypto speculation to building sustainable Web3 communities offers valuable lessons for anyone navigating this space.

Click the picture below to hear the full Spaces.

Crypto Endevr is always on the lookout for the latest news and trends in the world of blockchain technology, but it’s not possible without you. Thank you for your support. We look forward to navigating the crypto landscape together in 2025 and beyond!

This newsletter is not financial advice and should not be taken as such.