- TOKENS by Crypto Endevr

- Posts

- Agentic Trading in 2026: From Ideas to Reality

Agentic Trading in 2026: From Ideas to Reality

This Week on CRYPTO ENDEVR:

2025 was the year the market flirted with the idea of "AI on-chain." 2026 is the year that theory meets an uncompromising reality: the internet is becoming a living organism. For an autonomous AI agent, waiting three days for a traditional bank settlement is like a human waiting 300 years. The mismatch in speed has created a structural bottleneck that only high-throughput blockchains and autonomous wallets can solve.

In this edition, we break down the "Great Convergence" of AI, payments, and blockchain. We explore why Sui is transitioning from a Layer 1 blockchain to a unified developer platform, and how this architecture is specifically designed to host the next global workforce of AI agents. We also analyze Bitcoin’s resilient start to the year as it tests the $93,000 pivot zone.

Sui's object-centric model is proving to be the "Nervous System" for this new economy. While legacy chains struggle with the latency of human-led transactions, Sui is being redesigned at the protocol level to handle millions of machine-initiated microtransactions. The era of "Invisible Infrastructure" has arrived.

9:10pm EST 1/6

Sui Stack (S2) and the Agentic Web

Sui is poised to undergo its most significant evolution since mainnet launch. Mysten Labs co-founder Adeniyi Abiodun recently unveiled the Sui Stack (S2), a roadmap to transition Sui from a standard Layer 1 into a comprehensive, end-to-end decentralized development platform by the end of 2026. This isn't just a branding pivot; it’s a technical overhaul designed to optimize the network for "Agentic Web" capabilities.

Key components of the S2 roadmap include:

Agentic Web Optimization: Fine-tuning the protocol to prioritize machine-to-machine transactions and autonomous discovery.

Protocol-Level Privacy: Native, default private transactions that allow institutional agents to move capital without exposing sensitive strategy data.

Gas-Free Stablecoins: Plans to make stablecoin transfers completely free of gas fees, removing the final friction point for micro-scale agentic payments.

USDsui: The introduction of a native stablecoin to anchor the Sui economy as a unit of account for AI services.

By enshrining these features at the protocol level, Sui is moving away from the "neutral base layer" philosophy and toward an opinionated, high-utility "Operating System." For developers, this means the infrastructure for identity (SuiNS), storage (Walrus), and execution (Sui) is now a single, unified stack.

Macro Shift: From AI Assistants to AI Agents

Industries are moving past the novelty of generative chatbots toward autonomous workers that execute tasks without human supervision. In 2026, the primary metric for network success is shifting from "Total Users" to "Total Autonomous Volume." As enterprises move from pilots to production, the demand for "Verifiable AI" where an agent can prove its logic and identity on a public ledger is skyrocketing.

Several factors are driving this transition:

ZK-Machine Learning (ZKML): Allowing agents to prove their work is accurate without revealing the private data used for training.

The "Think-Verify-Pay" Loop: AI acts as the decision-maker (Think), Blockchain provides the truth layer (Verify), and Autonomous Wallets settle the value (Pay).

Institutional KYA: The emergence of "Know Your Agent" frameworks to allow regulated banks to interact with autonomous treasuries.

As these agents begin to negotiate, trade, and manage yield independently, Sui’s parallel execution engine provides the necessary "blazing speed" to prevent network congestion. In this new structure, the blockchain isn't just a ledger; it is the shared layer of trust that allows AI to move money as fast as it moves data.

MARKET ANALYSIS

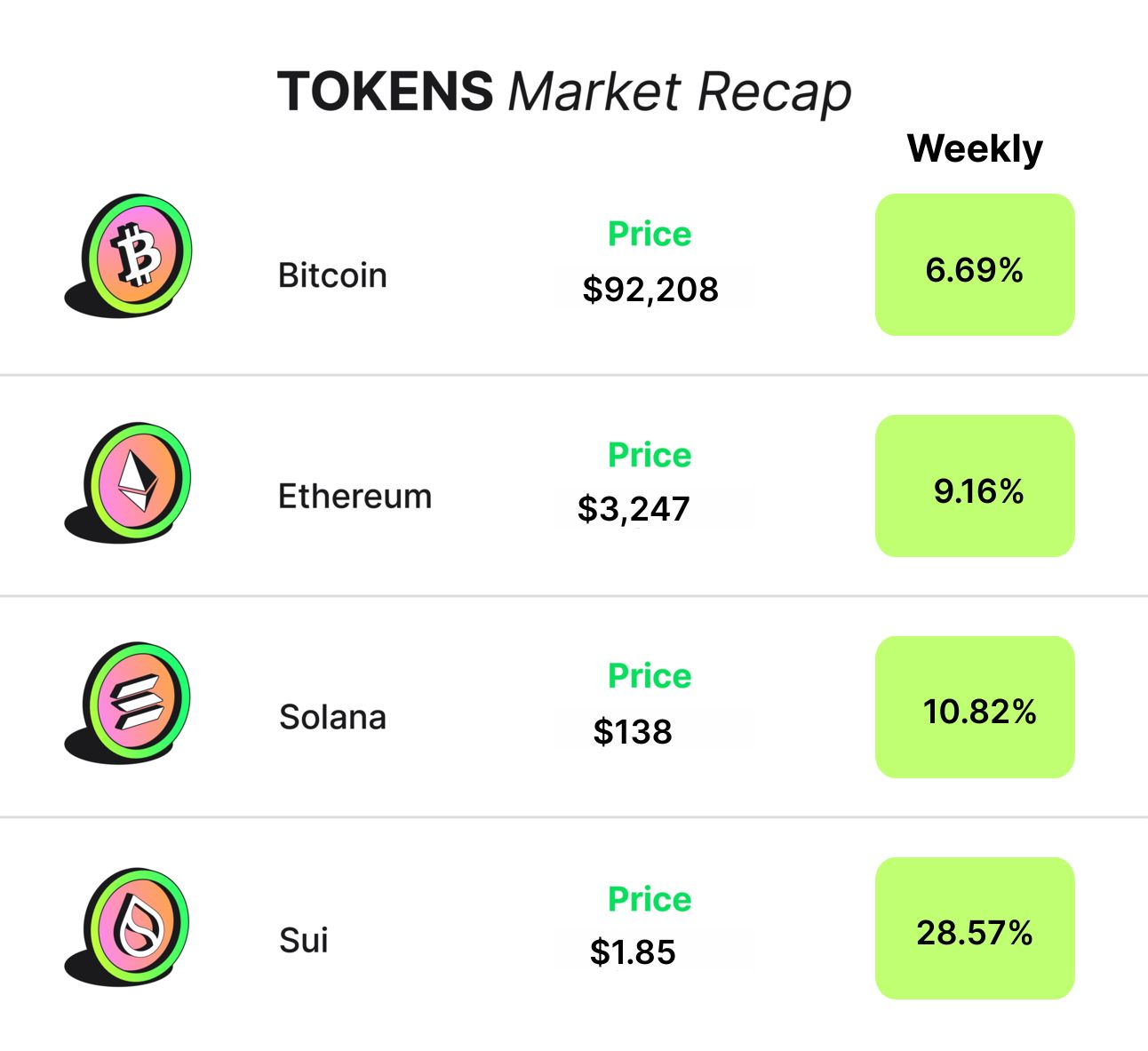

Bitcoin & Macro Markets Bitcoin has posted a solid start to 2026, successfully reclaiming and holding the $92,000 psychological zone. After a volatile December defined by tax-loss harvesting, January has seen a resurgence of institutional capital, with spot ETFs recording their largest single-day inflows since November.

Current Market Dynamics:

Price Action: BTC is currently trading near $92,800, with major resistance sitting at the $95,000 handle.

Institutional Inflows: Tether began the year by accumulating an additional $800 million in BTC, signaling strong conviction in a Q1 rally.

Macro Catalyst: Markets are now laser-focused on this Friday’s non-farm payrolls report, which will dictate the Fed’s trajectory for the remainder of the quarter.

Altcoin Highlights The Sui ecosystem continues to show resilience, with the price trending toward the $2.00 mark amid ETF filing hype and the S2 roadmap announcement. Elsewhere, the "Agentic Finance" narrative is boosting tokens across the AI sector, as investors rotate away from meme-driven cycles toward sustainable, revenue-generating on-chain businesses.

What to Watch This Week

Sui Ecosystem: Further details on the USDsui stablecoin integration and DeepBook’s margin trading launch.

Economic Data: US labor market data releases culminating in Friday's payrolls report.

AI Developments: New agent-native application launches as the "Agentic Web" begins its public rollout.

Final Thoughts The greatest technology shift of 2026 isn't a new token or a specific L1 it is the unceremonious formation of the converged internet. We are moving into a world where wages land instantly, factories pay suppliers the moment goods arrive, and your digital wallet manages your identity and assets without you ever having to click "Approve."

Sui is no longer just competing for TVL; it is competing for the orchestration layer of the global digital economy. The foundations are being laid, and the machines are already starting to build on top of them.

Thank you for being part of the Crypto Endevr community. We look forward to navigating this autonomous future together.

For News and Informational Purposes Only, Not Financial Advice